CFA Institute’s Code of Ethics and Standards of Professional Conduct codify the ethical guidelines for the investment profession that are critical to maintaining the integrity of capital markets and investor trust. Members, candidates, and even firms make a commitment to uphold these standards as they help elevate ethical decision-making universally around the globe.

As investment professionals, we are certain to face important ethical decisions in our day-to-day activities. Some scenarios we encounter will be straightforward, while others may be more complex. No matter what circumstances we face, continuous learning remains imperative in an investment industry that continues to evolve with products undergoing innovation and a regulatory environment continuing to adapt.

For that reason, each week we will feature a sample case from CFA Institute’s Ethics in Practice Casebook. Each case is built upon a real-life example that may involve a regulatory matter or even a CFA Institute Professional Conduct investigation. At the end of the case is a multiple-choice question that addresses the ethical nature of the actions taken in that case.

This week’s case involves Standard III(A) Loyalty, Prudence, and Care.

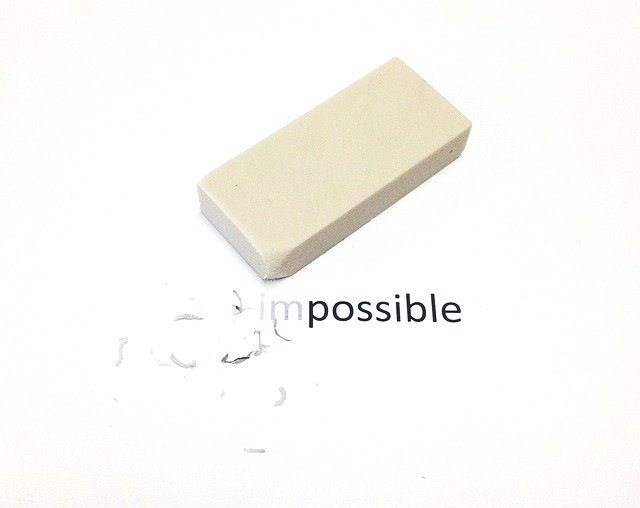

Using Erasable Ink Is Fine, Right?

Huang is a newly hired client account representative for GWC Asset Management, an investment adviser for high-net-worth clients. Part of Huang’s responsibility is to assist each new client complete the extensive documentation needed to open an account. These documents give GWC access to client assets and the discretion to trade on behalf of the client. Because Huang is new to GWC, he is not completely familiar with firm procedures and is afraid of making mistakes with the documents. He uses erasable ink in completing the documentation so he can easily fix any mistakes without having to go back to the client for additional signatures. Huang’s actions are

A. unacceptable under any circumstances.

B. unacceptable unless disclosed to the clients.

C. acceptable because he is providing efficient client service.

D. acceptable if GWC is aware of this practice.

What do you think is the correct choice? Feel free to discuss in the comments below and make sure to check back later this week as we post the analysis. The completion of this case qualifies for 0.25 hour of Standards, Ethics, and Regulation (SER) credit.

[Update – 8/13/2020]

Welcome back! Here is the analysis of this case:

Analysis:

This case involves the duty of loyalty to both clients and employer. By using erasable ink, Huang is rendering the key client documents changeable and thus unreliable. Once signed, anyone with access can go back and alter the terms or provisions of the documents. CFA Institute Standard III(A): Loyalty, Prudence, and Care requires members to “act with reasonable care and exercise prudent judgment” and “act for the benefit of their clients.” Using erasable ink for legally binding financial documents does not constitute reasonable care and prudent judgment, and it potentially causes harm to the clients. Even if Huang engages in this conduct to try to provide efficient client service (Choice C), he is really trying to protect his own interests and make his job easier while opening the client up to potential harm. Even if he discloses to clients that their documentation can be changed after the fact, he (or anyone with access to the documents) would still have free rein to make any changes. Huang must get client permission regarding the specifics of any changes to these important legal documents to make them effective, making Choice B incorrect.

It is irrelevant whether his employer, GWC, is aware of and acquiesces in the practice because the harm to the client remains (Choice D). In fact, engaging in this conduct without the knowledge of GWC would be a violation of CFA Institute Standard IV(A): Duties to Employers – Loyalty, which prohibits member form causing harm to their employer. Huang’s actions, if discovered, would cause great reputational damage for GWC with both the regulator and clients because the firm would have to go back through the process to redo all documentation. Finally, even if a client was aware of and gave permission to use erasable ink (or otherwise gave Huang or GWC permission to make changes to their documents without informing the client of what those changes were going to be), engaging in this conduct would make these documents ineffective and of no value. Huang would be violating the CFA Insitute Code of Ethics that requires members to act with integrity, competence, and diligence. Therefore, using erasable ink for client documents is inappropriate under any circumstances (Choice A).

This case is based on facts provided by Nick Pollard, Managing Director of Asia Pacific for CFA Institute, gathered from his industry experiences.

Image by tigerlily713 from Pixabay

© 2018 CFA Institute. All rights reserved. You may copy and distribute this content, without modification and for non-commercial purposes, provided you attribute the content to CFA Institute and retain this copyright notice. This case was written as a basis for discussion and is not prescriptive of how a business situation or professional conduct matter should or should not be handled or addressed. Certain characters mentioned are fictional to facilitate discussion, and any resemblance to actual persons is coincidental.